As noted in our recent post, Should You Help Your Adult Children Financially?, the children of the...

Should You Help Your Adult Children Financially?

Most of us assumed (or hoped) our children would be independent when they entered adulthood. However, many parents from the Baby Boom generation (1946-1963) continue to support their adult children financially.

This trend surprised Boomers whose wealth accumulation surpassed previous generations. Boosted by a generally robust post-WWII world economy, Boomers may hold the "wealthiest generation" crown for some time because many experts predict the generations immediately following won't be as lucky.

For example, when the Boomers were under 40, they accounted for 13.1% of total U.S. wealth. When members of the next generations, Gen X (1946-1963) and Millennials (1979-1995), were under 40, they represented only 6%.

It's no wonder these generations have struggled to gain wealth, considering the financial turmoil occurring in their critical early earning years:

- Black Monday US stock market crash (1987)

- Savings and Loan Crisis (1986-1995)

- Y2K financial disruptions 1999-2000

- September 11 attacks (2001)

- Financial crisis of 2007–2008, which set off the Great Recession (2007-2009)

- Financial turbulence caused by the COVID-19 pandemic (2020–present)

While Boomers were exposed to the same events, they experienced more consistent growth in their early earning years, fueled primarily by ever-rising stock prices and a booming housing market. As a result, they generally accumulated enough wealth to weather bad times.

The resulting wealth gap bears stark implications. As a report by the Washington think tank, New America states,

"Since these younger families are entering or are in their prime earning years, this raises the question of whether they will be able to get back on track or risk becoming a "lost generation" in terms of wealth accumulation."

The post-Boomer generations continue to face other financial hurdles as well. These will be covered in an upcoming post.

The Coming Wealth Transfer Tsunami

For all its apparent gloominess, the generational wealth gap could be temporary. The Federal Reserve calculates that the Baby Boomer generation currently holds around $78 trillion in assets, a sizable portion of which is liable to be inherited by their families. Experts predict the bulk of this transfer will occur between now and 2043.

However, this figure is misleading for a couple of reasons.

First, wealth inequality within the Boomer group will channel 42% or about $36 trillion of this wealth to the families in the top 1%. On the flip side of the inequality equation, a 2019 Insured Retirement Institute study found that around 45% of Boomers had $0 in retirement savings. Sadly, half of these had retirement savings in the past.

Second, while the remaining $42 trillion still stands as an impressive figure, Boomers' children shouldn't expect a big lump sum anytime soon. The majority of the Boomers will be around for some time to come, and they will be spending their money. For example, a 2021 survey found that 75% are more interested in spending their retirement savings on enjoyable pursuits than leaving money to their beneficiaries.

Beyond these discretionary expenditures, the amount Boomers will spend on retirement necessities has increased, with healthcare and long-term care being the primary drivers.

The Fidelity 2023 Retiree Health Care Cost Estimate projects that an average couple will spend $315,000 on healthcare costs during retirement, representing a 96% increase since 2002.

As for long-term care costs, Genworth estimated in 2020 current annual long-term care costs in these categories:

| Adult Day Health Care | $ 19,240 |

| In-Home Health Aide | $ 54,912 |

| Assisted Living | $ 51,600 |

| Skilled Nursing Facility - Semi-Private Room | $ 93,075 |

| Skilled Nursing Facility - Private Room | $105,850 |

Genworth noted that annual costs rose 1.9% to 3.8% between 2004 and 2020, depending on the care category. If increases continue annually at a 2.5% rate, these costs will more than double by 2050.

Nevertheless, many Boomer parents will not wait until they die to transfer some of their wealth to adult children.

Want to learn more about helping your adult children financially? Click here or the button below to download our eBook: Helping Your Adult Children Financially: Volume 1 – Why They Need Help.

As a result of the generational wealth gap, many Boomer parents have chosen to help their adult children financially today rather than making the kids wait for an inheritance.

A study by Savings.com showed this is a pervasive trend:

- 45% of parents provide some form of financial support to at least one of their adult children, excluding 6% of parents supporting an adult child with a disability

- The average monthly support amount was $1,400, primarily for housing, groceries, and cell phone costs

- About 1 out of 5 (21%) parents providing support helped with student loan payments to an average of $245 monthly

As for healthcare insurance, the 2010 Affordable Care Act allows parents to keep dependents on their plans until age 26. Looking at parents of millennials, Fortune magazine reports that 17% continue to cover adult children.

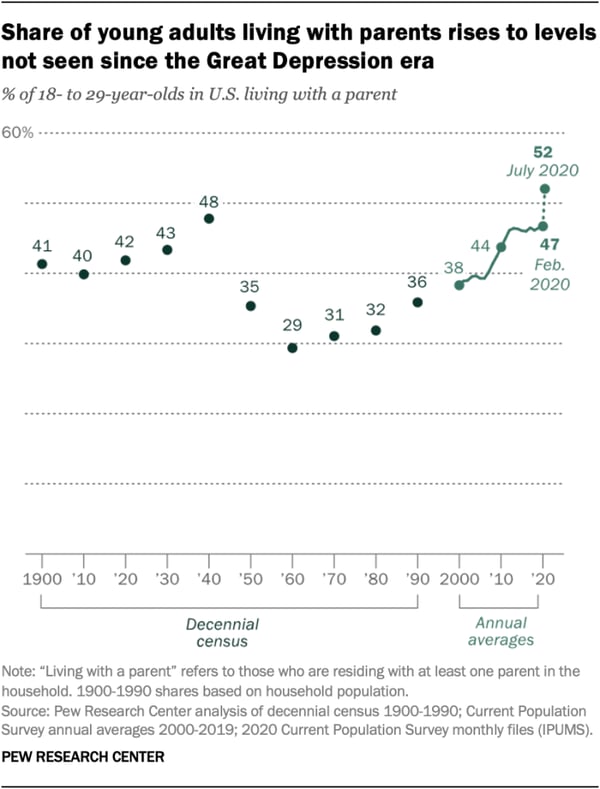

Another study by the Pew Research Center found a growing trend of young adults (ages 18-29) living with their parents. In 1960, census figures showed that 29% of young adults lived with one or more parents. By 2010, this rose to 44%, and by 2020, the pandemic spiked the figure to 52%, the highest rate since the closing years of the Great Depression (48%). Chief among the driving forces for this phenomenon were high housing costs and student loan payments.

Some pundits see this as a logical response to the financial pressures faced by post-Boomer generations, allowing them a safe haven to pay off student loans and save for future home ownership.

The Perils of Helping

While parents may feel at peace with throwing financial lifelines to their adult children, they should also bear a couple of caveats in mind.

First, will helping your adult children jeopardize your own financial standing? As noted above, a significant proportion of Boomer parents have no retirement savings, and others have a minimal amount. If helping your kids worsens your own money situation significantly, you risk the prospect of a diminished lifestyle at a time when you can least afford it, especially from a healthcare perspective.

Second, will helping your adult children prevent them from learning how to be independent? There are ways to help that could perpetuate a cycle of dependence. Conversely, moving through the assistance process–with a focus on building skills and experience for eventual independence–makes better sense.

This is Part 1 in our series about helping children financially! Subscribe to our blog to receive notifications about the rest of the series!